Your Trucking Compliance Experts

Fast, friendly, and knowledgeable experts ready to assist with your trucking authorities, permits, and registration needs.

Keep Your Trucking Business Compliant

Download Our Free Checklist

Our Services

Intrastate

Apply for CA# and US DOT#

Motor Carrier Permit and Renewals

Tax ID#

2290 Filing

Apply for your Employer Pull Notice

Drug Consortium

CARB

HD/IM

Interstate

Apply for US DOT#, CA# and MC Authority

BOC-3 Process Agent

Apply for a Fuel Tax License (IFTA) and quarterly report

UCR

Oregon Monthly Reporting

New Mexico Quarterly Reports

Kentucky KYU Permit

Prepass

IRS 2290 Heavy Highway Use Tax

IRP Registration

Drug Consortium

CARB

HD/IM

Company Formations

Limited Liability Company Filings

Corporation Filings

Company EIN (tax ID number)

Renewals

Title Transfers

PTI Trailer Renewals

Mobile VIN Verifications

ABOUT US

Who we are

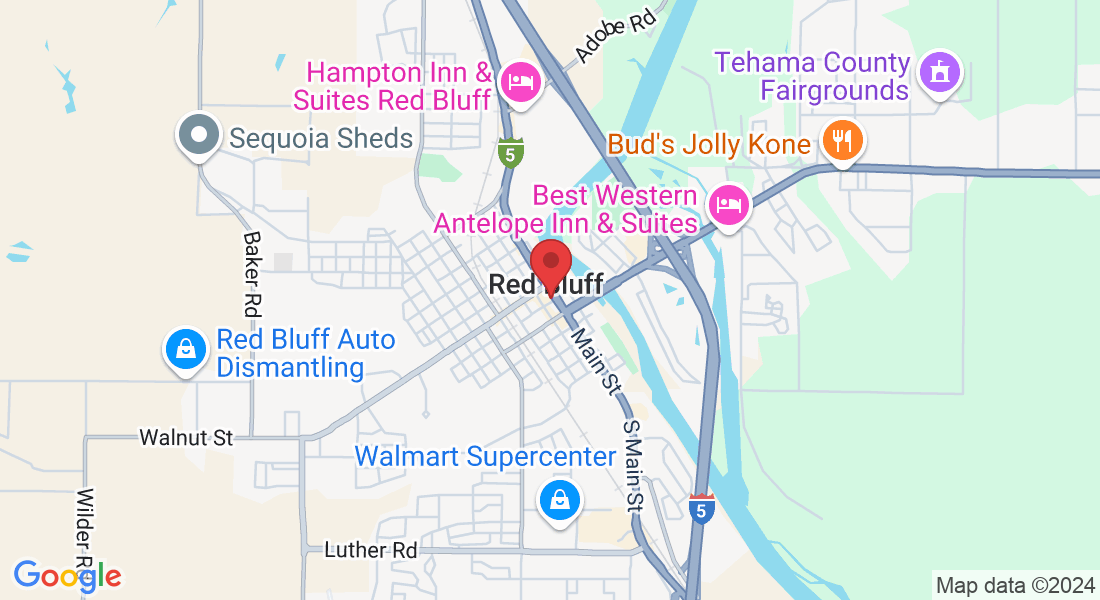

We understand that keeping compliant with your trucking business is difficult and time consuming. Our mission is to take care of all your paperwork so you can get back on the road trucking. We are a family-owned business, and we know the importance of exceptional customer service and hard work.

Alicia

Cassie

Customer Testimonials

Alberto

"Thanks to Authorities Plus, we were able to start working 6-7 months earlier"

Sarah

"They're quick, pain-free..."

Our ServICES

Clean Truck Check

Tailor your insurance coverage to fit your specific needs with our customized plans. From basic liability to comprehensive coverage, we offer flexible options that suit your budget and lifestyle.

Comprehensive Compliance Audit

Never worry about being stranded again. Our 24/7 roadside assistance service is here to help you with everything from flat tires to lockouts, ensuring you get back on the road quickly and safely.

FAQS

Why rely on Authorities Plus instead of getting permits myself?

We make handling your operating authority easier so you can focus on your business and your trucks can get on the road faster. Our team knows the ins and outs of registration and credentials, which allows us to get your paperwork done quickly and accurately.

What is needed to travel intrastate in California?

For non-CDL carriers, a California ID number and the California Motor Carrier Permit (for vehicles over 10,001 lbs GVW or CGVW) are needed. For CDL carriers, a California ID number, California Motor Carrier Permit (for vehicles over 10,001 lbs GVW or CGVW) and the California EPN (Employer Pull Notice) Code are needed. Authorities Plus offers options to bundle these credentials together. Contact us today to get on the road faster! Learn more about California Intrastate needs here.

How long will it take for you to handle my operating authority request?

We work immediately to get the paperwork in progress. And while we can’t control how quickly the Federal Motor Carrier Safety Administration (FMCSA) and other entities act, we’ll do everything in our control to make the process as efficient and streamlined as possible.

Can you set up my IFTA/IRP accounts?

Yes, contact us today to learn how we can help complete the application process on your behalf.

My USDOT number has been deactivated. What should I do?

The USDOT number can be deactivated for a number of reasons. Our team of Regulatory Advisors can help you understand what happened and, more importantly, help get you back on the road and operating legally.

When do I need the 2290 Heavy Vehicle Use Tax?

Vehicles over 55,000 lbs require the HVUT 2290 filing. Visit 2290online.com to learn more.

Why does the FMCSA show me as "Not Authorized"?

Your operating authority can be not authorized different reasons. Our team of Regulatory Advisors can help you understand why and what is needed to get your authority on the right track.

What other permits does my business require?

There are states that require additional intrastate authority permits to operate in their state. Our team of Regulatory Advisors can help you understand what else may be needed based on your travel.

Which states require weight distances taxes?

Connecticut, Kentucky, Oregon, New Mexico and New York all have weight-distance taxes in addition to IRP, IFTA and HVUT. These fees are based on the gross vehicle weight or gross combination weight and the miles operated in the state.

We have two DOT numbers, but we want to consolidate and deactivate one of them. How do we do that?

An unused USDOT number may be deactivated by submitting an updated MCS-150 or MCS-150B form. In the “reason for filing” section of the form, check the box labeled “Out of Business Notification.” If the entity had for-hire authority, that needs to be canceled separately using Form OCE-46 to request a voluntary revocation of the authority. Note that if one entity under one Federal Employer ID Number (FEIN) has more than one USDOT number, the numbers should be consolidated. Two entities under separate FEINs should not share a USDOT number, even if related.